How to create and use Delta AI abstract accounts

We will describe how to use Delta AI to trade on top of a lending protocol.

Create an account

To begin trading, you will need to create a Delta AI account. The account provides you with flexibility, control and is very cheap to create — only minor gas fees are incurred.

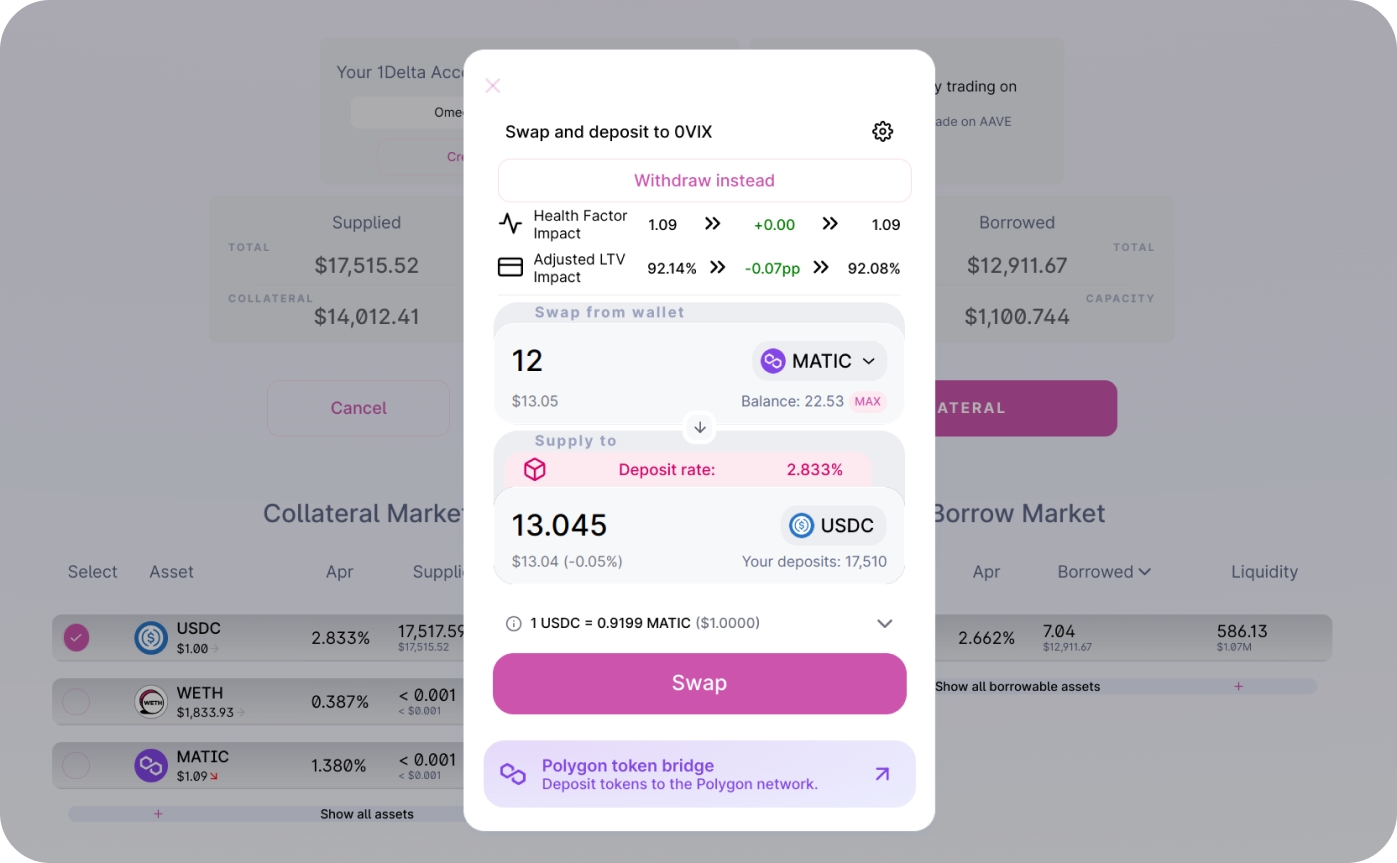

Deposit collateral

Once the account is created, you can deposit funds to the lending protocol. If you do not currently own the token you want to deposit, you can also swap and then supply in the same transaction using a Uniswap-style interface:

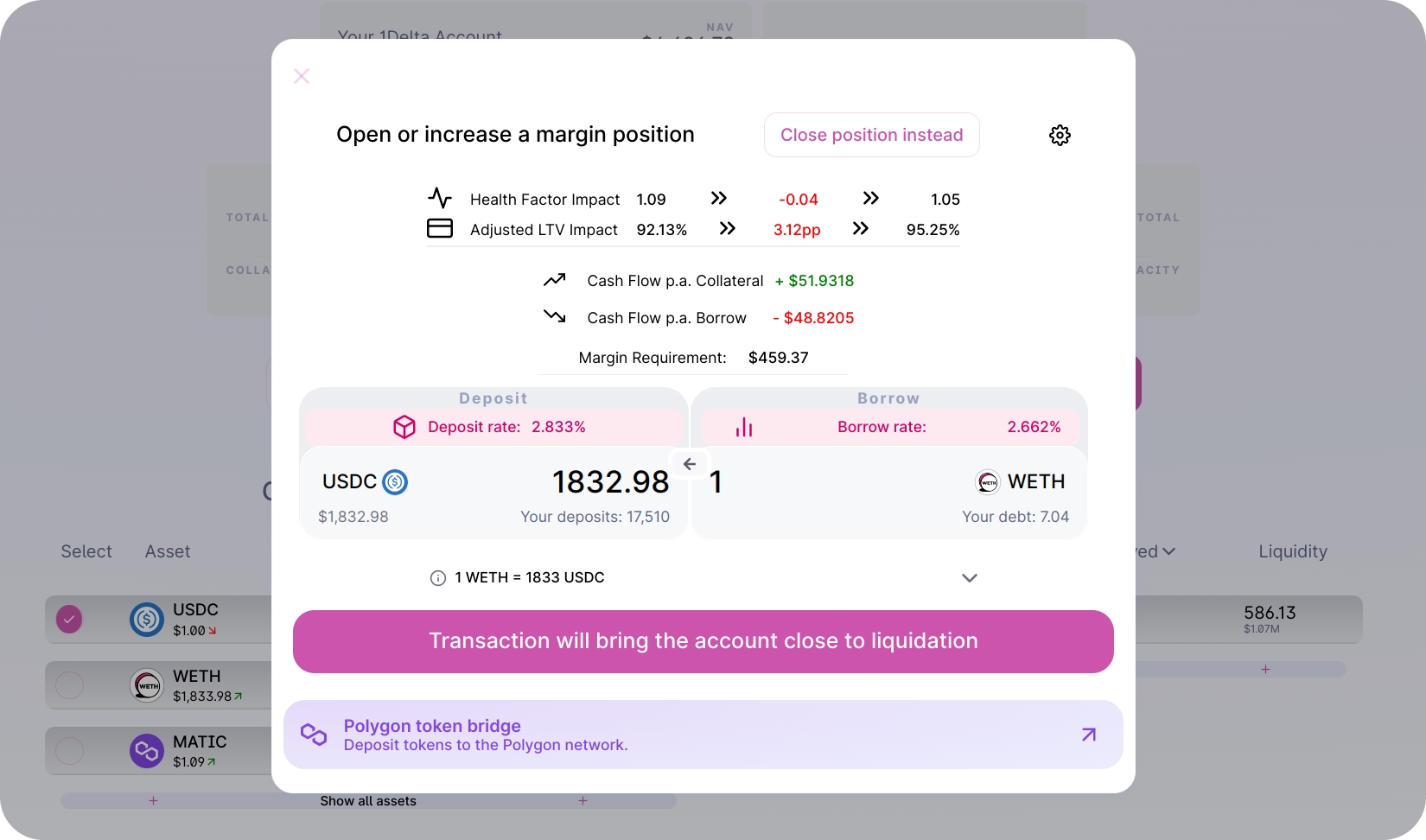

Open a margin position - Borrow, Swap and Supply in a single Click

It is now time to trade on margin. With your deposited collateral you can now use the full capacity of your borrowing power. The following screenshot shows an indication of a position increase where WETH is borrowed and sold for USDC - which is directly deposited. All the relevant risk parameters are shown, in the scenario, the user sees a warning that the account will get close to liquidation after execution.

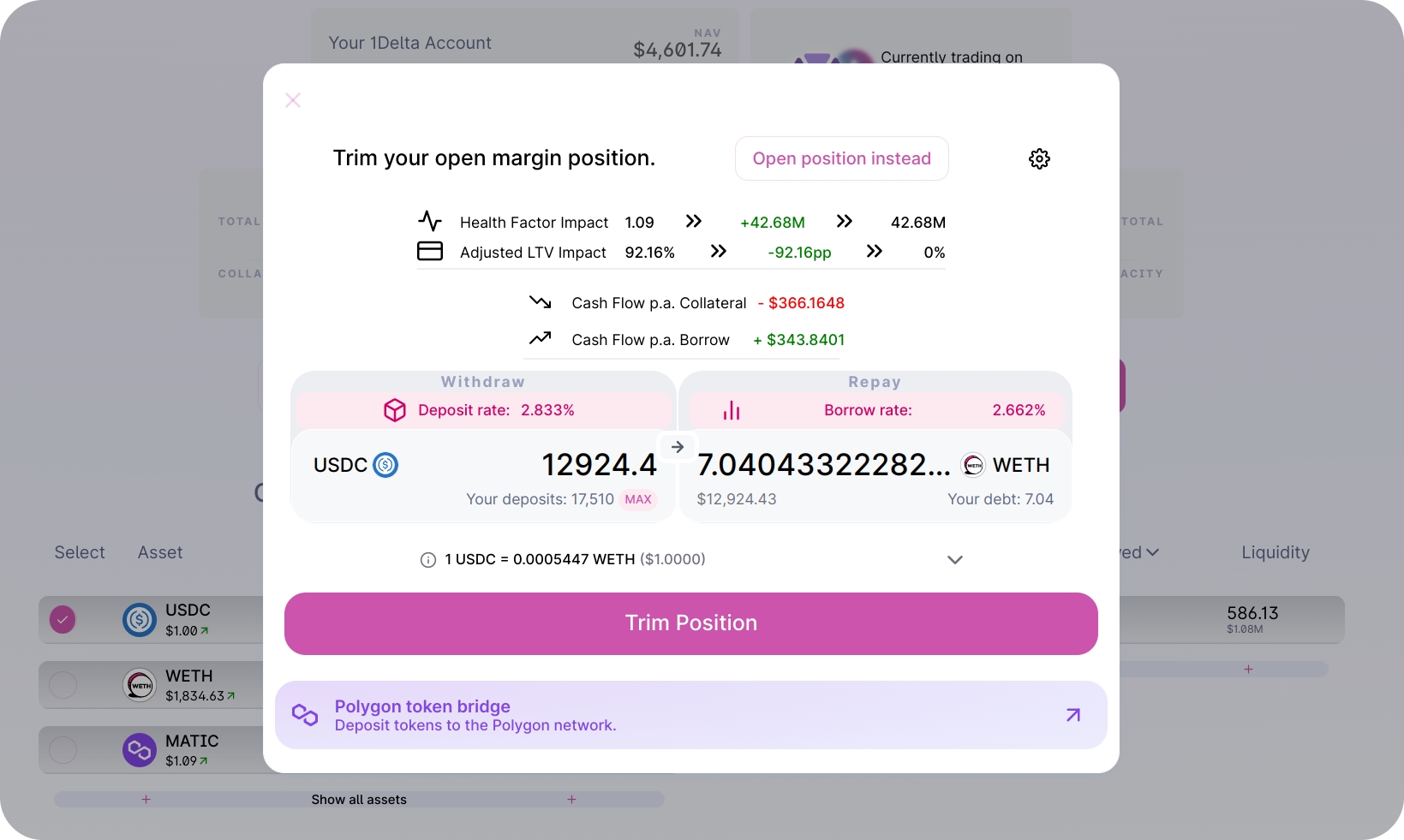

Close a margin position - Withdraw, Swap and Repay in a single Click

If our health factor gets very low, the manual withdraw-swap-repay cycle would lead to a significant hassle when trying to unwind the position, all while Delta AI executes the interactions in a single transaction:

We can see that the health factor jumps up and the LTV drops to zero. On top of that, Delta AI's implementation prevents dust if you pick the maximum amount for closing a position.

Last updated